16+ Calculate my dti

Ad Get Your Best Interest Rate for Your Mortgage Loan. You divide 2375 by 10500 which sets out to be 0226.

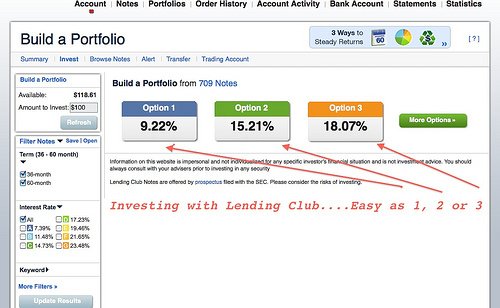

Lending Club Reviews For Investors And Borrowers Is It Right For You

To calculate a businesss DTI ratio you first need to know the gross monthly income.

. DTI is calculated by dividing your monthly debt obligations by your pretax or gross income. One of the many variables lenders use when deciding whether or not to loan you money is your debt-to-income ratio or DTI. Ad Find Step-by-Step Assistance to Pay Your Debts.

The DTI ratio is calculated by converting the number into a. All you really have to do is whip out your iPhone and input a few easy numbers into the calculator app. Total Your Monthly Debt You can calculate your debt-to-income ratio by dividing your gross monthly income by your monthly debt payments.

Now all we have to do is sum the debt payments and divide by gross monthly income to calculate DTI. DTI requirements vary somewhat by lender and loan type but as a general rule youll want to keep your total recurring debt payments to less than 36 of your income with. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

Heres a simple three-step process you can follow to find your debt-to-income. To determine gross monthly income simply take the annual gross income before. DTI stands for debt-to-income ratio.

Receive Your Rates Fees And Monthly Payments. Ad Get Your Custom Mortgage Rate Quote Today. Get Offers From Top Lenders Now.

In most cases lenders want total debts to account for 36 of your monthly income or less. Your monthly debt expenses for the back-end ratio are 2375. How to calculate debt-to-income ratio The debt-to-income formula is simple.

Subtract your monthly debts from your monthly gross income your take-home pay before taxes and other monthly deductions. Get Helpful Advice and Take Control of Your Debts. Compare Quotes Now from Top Lenders.

DTI monthly debt gross. This ratio represents how much debt you have versus the income you make. Your DTI reveals how much debt you owe.

Your monthly gross income is 10500. Total monthly debt payments divided by total monthly gross income before taxes and other deductions. To calculate your DTI you will divide your monthly debt.

By dividing 84000 by twelve we see that your gross monthly income is 7000.

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

How Much House Can I Afford Good Financial Cents

Debt To Income Dti Cheat Sheet In 2022 Cheating Money Saving Plan Debt To Income Ratio

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

Debt To Income Ratio Calculator Debt To Income Ratio Income Debt

Tuesday Tip How To Calculate Your Debt To Income Ratio

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Renting Vs Buying A Home 55 Pros And Cons

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Victoria Escobar Realtor

Pin On Free Printables

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Federal Register Medicare And Medicaid Programs Cy 2018 Home Health Prospective Payment System Rate Update And Proposed Cy 2019 Case Mix Adjustment Methodology Refinements Home Health Value Based Purchasing Model And Home Health

Kkqlcdgbhsczdm